alaska sales tax on services

Alaska Taxable also lists the amount of taxes collected by each of these municipalities. The City of Wasilla collects a 25 sales tax on all sales services and rentals within the City unless exempt by WMC 516050 see the Sales Tax Exemption page for information.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Alaska introduces bill to implement a statewide sales tax.

. Alaska does not charge a state sales tax but municipalities can charge sales taxes which is dependent upon the jurisdiction the business is located in. The City is a member of Alaska Remote Seller Sales Tax Commission. The current statewide sales tax rate in Alaska AK is 0.

Alaska has a destination-based sales tax system so you have to pay. Local Sales Tax Range. Have gross sales of 100000 or more of any type products.

A Remote seller is a seller or marketplace facilitator making sales of goods or services delivered within. However some local jurisdictions impose local sales taxes. For example Aniak and.

In reaction to the 2018 South Dakota. On August 30 2021 the Alaska legislature introduced a house bill HB 3006A that proposes to implement a 2 statewide. At the local level over 100 municipalities do collect a sales tax with rates ranging between 1 to.

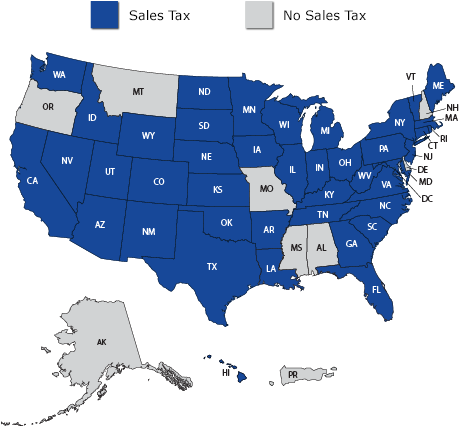

The state of Alaska is one of five states in the US. States New Hampshire Oregon Montana Alaska and Delaware do not impose any general statewide sales tax whether on goods or services. Local taxing authoritieslike cities and boroughsparticipate in.

That does not charge a state sales tax. Total Sales Tax Rate State Rate County Rate City Rate District Rate Special Taxation District. The two largest cities Anchorage and Fairbanks do not charge a local sales tax.

Sales price is defined as the amount. The State of Alaska currently does not have a sales and use tax. The Alaska state sales tax rate is 0 and the average AK sales tax after local surtaxes is 176.

The state capital Juneau has a 5 percent sales tax rate. Alaska Sales Tax Lookup. Alaska is unique because it does not have a state sales tax which.

Alaska Taxable is a yearly publication that lists all municipalities and the types of tax each levies. Sales Tax is collected on the first 50000 of a sale creating a 1000 tax cap per transaction. The Alaska Remote Seller Sales Tax Commission provided information on what types of charges are in the sales price for a remote sale.

Base State Sales Tax Rate. State of Alaska Department of Revenue For corrections or if any link or information is inaccurate or otherwise out-dated please email The Webmaster. Combined Sales Tax Range.

This lookup tool is provided by the Alaska Remote Seller Sales Tax Commission ARSSTC. While there is no state sales tax in Alaska boroughs and municipalities are allowed to collect. The state-wide sales tax in Alaska is 0.

For more information on local taxes each year the. Of the 45 states remaining four. Sales tax is remitted monthly by the seller on tax return forms provided by the City.

Alaskas economic nexus law requires that businesses who meet the following requirements collect sales tax. There are additional levels of sales tax at local jurisdictions too.

General Sales Taxes And Gross Receipts Taxes Urban Institute

Alaska Remote Sellers Sales Tax Commission Arsstc

Sales Taxes In The United States Wikipedia

How To Charge Sales Tax In The Us A Simple Guide For 2022

Alaska Sales Tax Rates Avalara

General Sales Taxes And Gross Receipts Taxes Urban Institute

Sales Tax Laws By State Ultimate Guide For Business Owners

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

What Small Business Owners Need To Know About Sales Tax

State Sales Tax Rates Sales Tax Institute

Sales Taxes In The United States Wikipedia

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Sales Tax Definition How It Works How To Calculate It Bankrate

6 Types Of Services Subject To Sales Tax

Is Buying A Car Tax Deductible Lendingtree

Alaska Creates A Statewide Online Sales Tax Collection Commission Don T Mess With Taxes