does tennessee have estate or inheritance tax

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. But dont forget about the federal estate tax.

Illinois Should Repeal The Death Tax

All inheritance are exempt in the State of Tennessee.

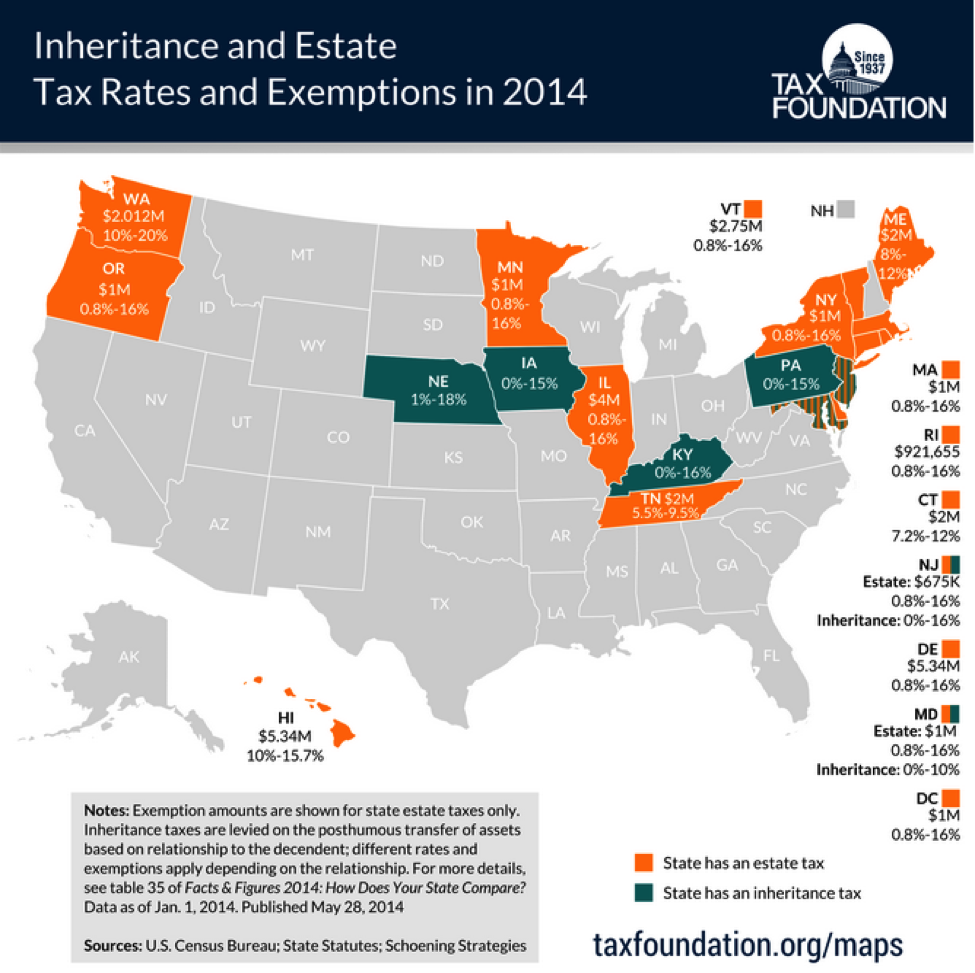

. The Federal estate tax only affects02 of Estates. Technically Tennessee residents dont have to pay the inheritance tax. Twelve states and the District of Columbia collect an estate tax at the state level as of 2022.

Final individual federal and state income tax returns. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. This is great news for residence.

The taxes that other states call inheritance taxes are not based on the total value of the estate. Alabama and Hawaii also. The inheritance tax is paid out of the estate by the executor administrator or trustee.

Tennessee is an inheritance tax and estate tax-free state. All inheritance are exempt in the State of Tennessee. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

In 2015 the Tennessee estate tax applied to high value estates that were worth more than 5 million. It is one of 38 states with no estate tax. Oklahoma and Kansas have also repealed their estate taxes.

Generally speaking inheritances are not subject to income taxes but there are estate taxes that can affect high net worth individuals. Some states have inheritance tax some have estate tax some have both some have none at all. They are imposed on the people who inherit from you and the tax rate depends on your family relationship.

Wyoming has among the lowest property taxes in the US. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Federal estatetrust income tax return.

Tennessee does not have an estate tax. Up to 25 cash back Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. The net estate less the applicable exemption see the Exemption page is taxed at the following rates.

Tennessee is an inheritance tax and estate tax-free state. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Indiana Ohio and North Carolina had estate taxes but they were repealed in 2013.

Any amount in excess of the federal exemption will be subject to estate tax. In fact it doesnt matter the size of your estate there will be no state level tax assessed. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer Mendelson Law Firm Memphis TN Estate Planning Creditors Rights Attorneys Call Now 901 763-2500 866 997-6325 Fax.

Until that time estate administrators must continue to file the appropriate returns and pay the required estate taxes if the estate is larger than the amount of the exemption. About Tennessee Title VI Accessibility Help. Each due by tax day of the year following the individuals death.

Inheritance Tax in Tennessee There are NO Tennessee Inheritance Tax. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. For the purposes of this post we are going to address the last question about Tennessees inheritance tax.

In 2016 the inheritance tax will be completely repealed. Those who handle your estate following your death though do have some other tax returns to take care of such as. Federal state tax exemption.

According to the Tennessee Department of Revenue Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Estate Tax In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time. The average effective property tax rate in Wyoming is just 057.

Wyoming has a 400 percent state sales tax a max local sales tax rate of. NO INHERITANCE OR ESTATE TAX. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

There are NO Tennessee Inheritance Tax. See where your state shows up on the board. Contents hide 1 What is the state of Tennessee inheritance tax rate.

Tennessee is not impose an estate tax. However it applies only to the estate physically located and transferred within the state between Tennessee residents. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

Instead inheritance taxes are directly imposed upon the beneficiaries or heirs of an estate. 4 The federal government does not impose an inheritance tax. The inheritance tax is due nine months after death of the decedent.

Tennessee followed suit in 2016 and New Jersey and Delaware eliminated their estate taxes as of 2018. For example the neighboring state. The inheritance tax is no longer imposed after December 31 2015.

When other states refer to inheritance taxes they are not referring to the total value of an estate.

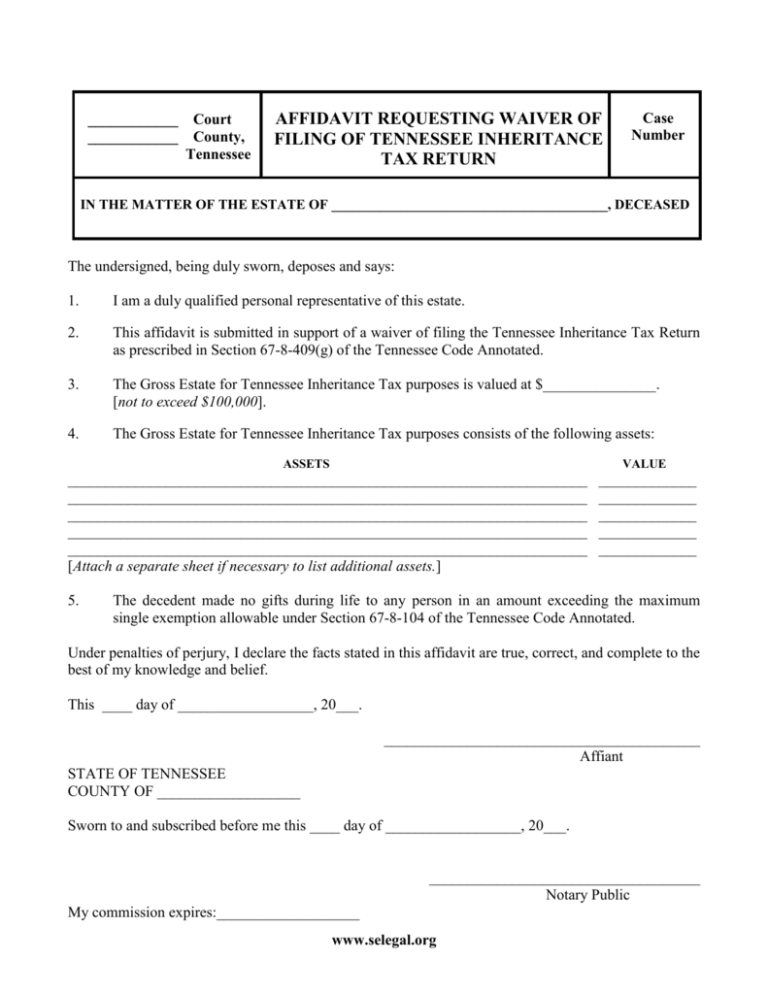

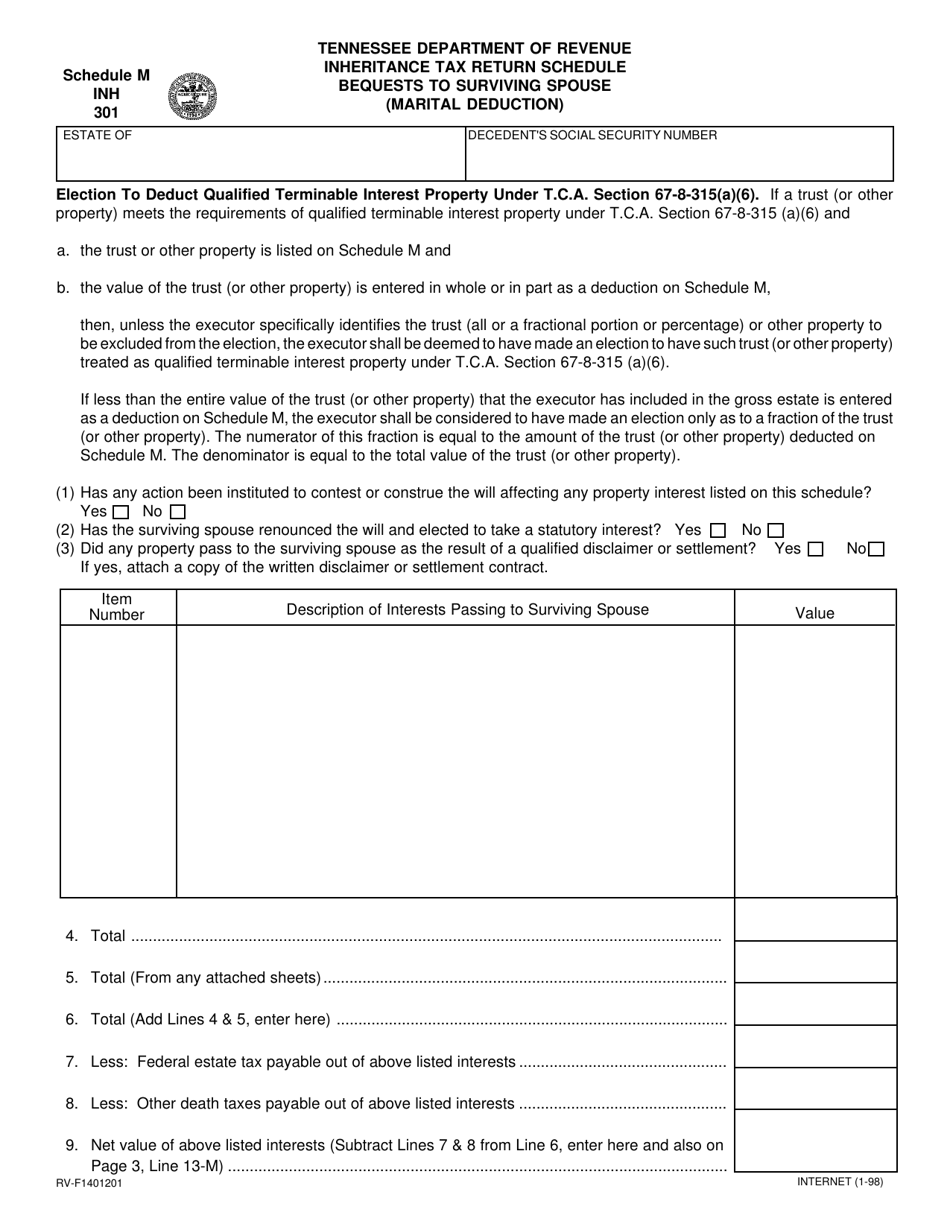

Affidavit Regarding Inheritance Tax Return

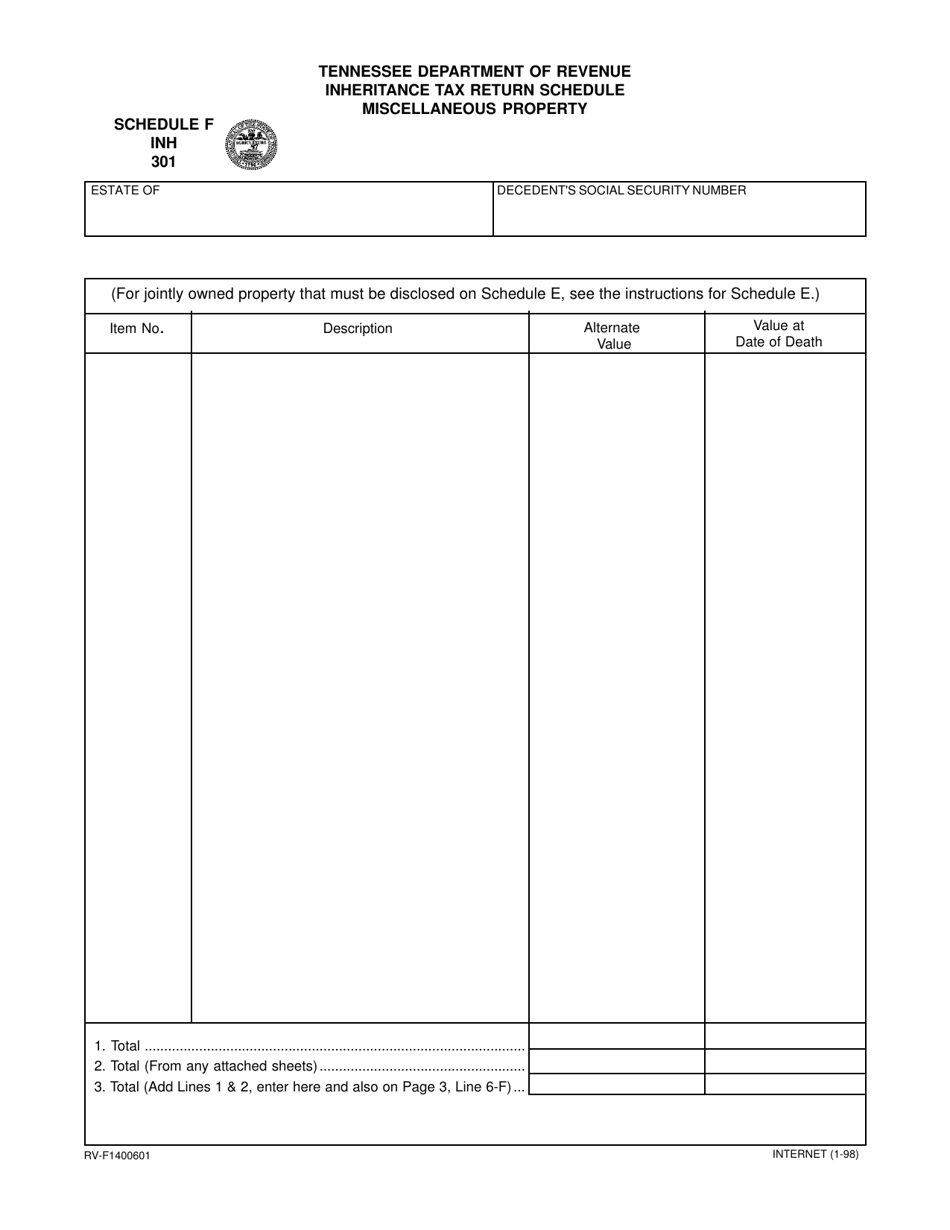

Form Rv F1400601 Inh301 Schedule F Download Printable Pdf Or Fill Online Inheritance Tax Return Schedule Miscellaneous Property Tennessee Templateroller

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

The 35 Fastest Growing Cities In America City Cheap Houses For Sale Best Places To Live

States You Shouldn T Be Caught Dead In Wsj

Probate Fees In Tennessee Updated 2021 Trust Will

Form Rv F1401201 Inh301 Schedule M Download Printable Pdf Or Fill Online Inheritance Tax Return Schedule Bequests To Surviving Spouse Marital Deduction Tennessee Templateroller

Individual And Consumption Taxes Tax Foundation

How To Create A Living Trust In Tennessee

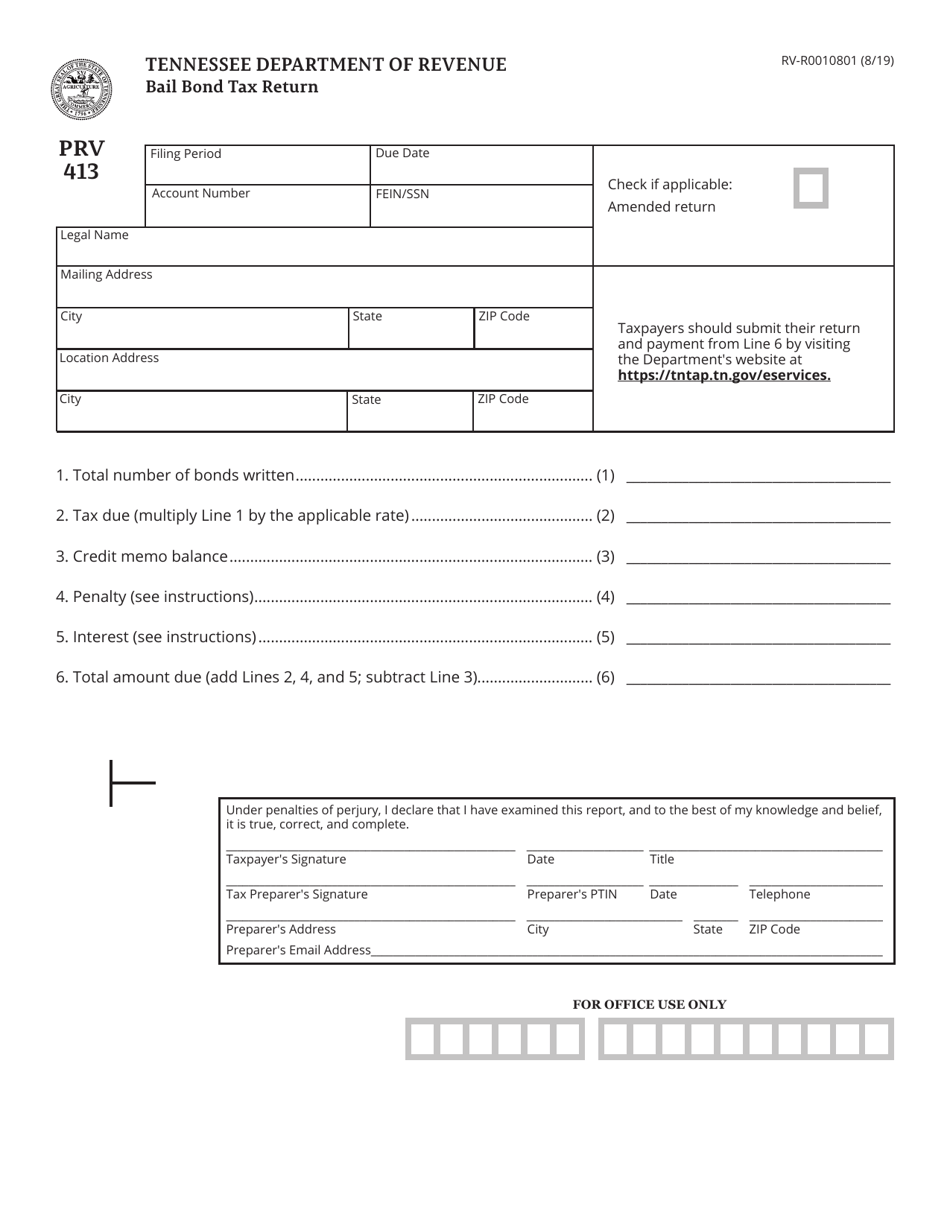

Form Prv413 Rv R0010801 Download Printable Pdf Or Fill Online Bail Bond Tax Return Tennessee Templateroller

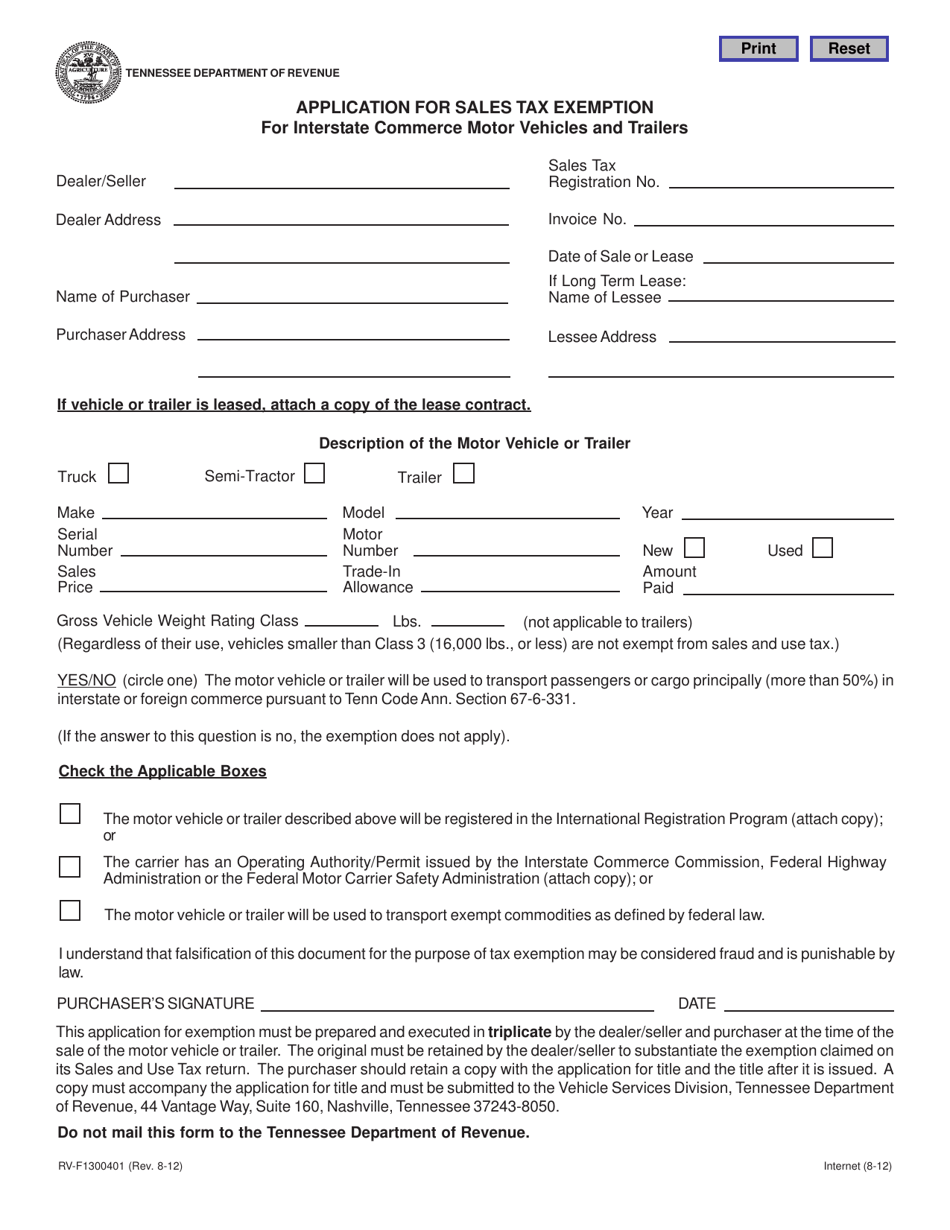

Form Rv F1300401 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption For Interstate Commerce Motor Vehicles And Trailers Tennessee Templateroller

Estate Planning Tax Rule You Should Know Batsonnolan Com

Divorce Laws In Tennessee 2022 Guide Survive Divorce

10 Slow Paced Small Towns In Wyoming Where Life Is Still Simple Wyoming Vacation Wyoming Wyoming Travel

Form Inh Waiver Application For Inheritance Tax Waiver

How Do State Estate And Inheritance Taxes Work Tax Policy Center