osceola county property taxes due

The tax collector will mail your first notice of payment due with instructions. The delinquent amount is not reflected on this notice and must be paid with guaranteed funds.

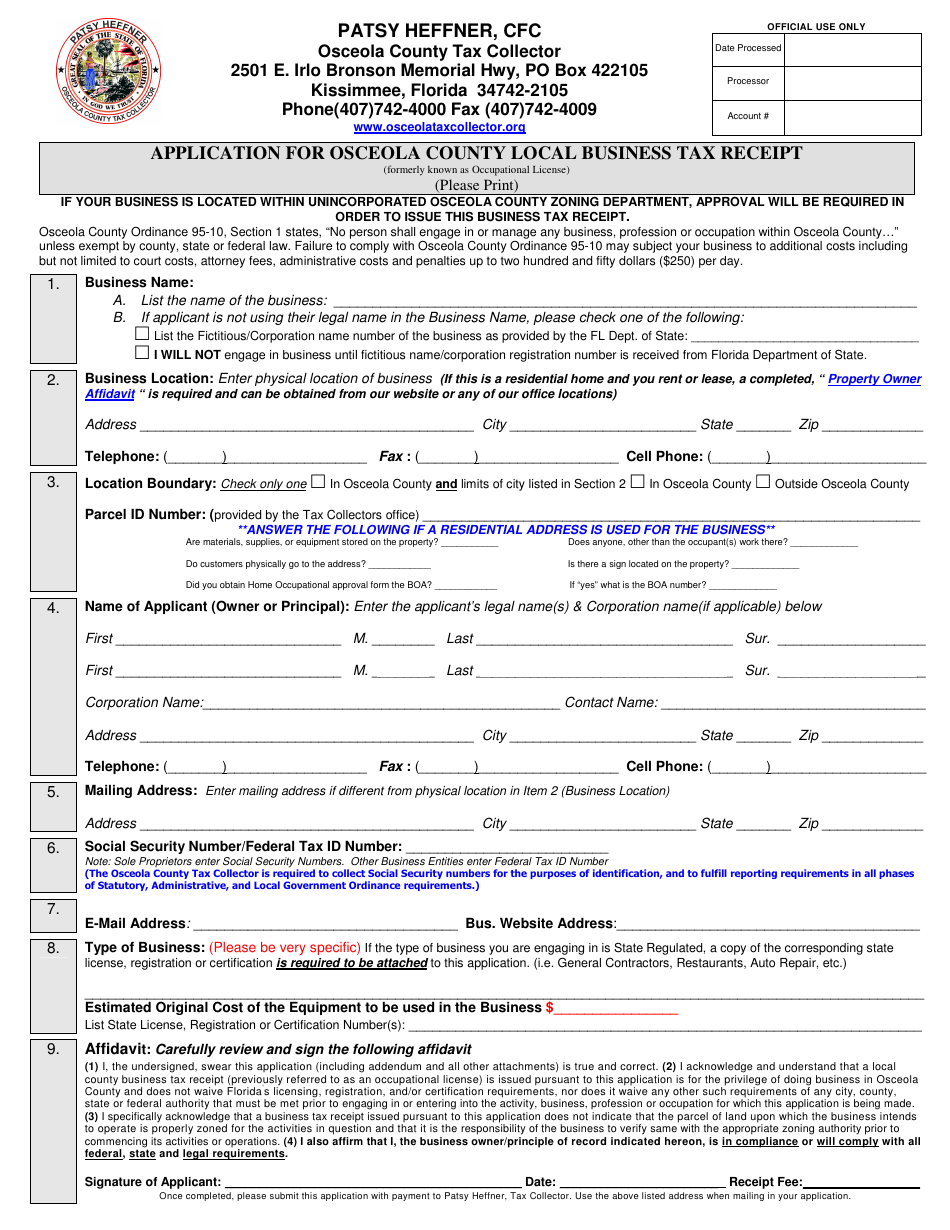

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

. If you have not received your first notice by June 15 contact your county tax collectors office. A tax certificate when purchased becomes an enforceable first lien against the real estate. Winter taxes are due by February 14 without penalty.

Discover Mastercard Visa and e-Check are accepted for Internet Transactions. Osceola County Florida Property Search. Gross rental receipts city of.

The Tax Collectors Office is pleased to bring you the. Osceola County has relatively high median property taxes with the property tax being around 095 of the propertys assessed fair market value. 6 - PRIOR YEARS TAXES DUE DELINQUENT TAXS OWED.

Property Taxes Are Due. Call 407 742-4000 for amount due. All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest.

First Half of Taxes DUE Septmeber 1st. Fill in the form below to sign up for email delivery of tax bills for this account. Plus - interest 10.

Local Business Tax Receipts become delinquent October 1st and late fee applies. The Tax Collectors Office provides the following services. Osceola County Tax Collector.

My team and I love connecting with the community and look forward to future parades. Osceola County collects on average 095 of a propertys assessed fair market value as property tax. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

Enjoy online payment options for your convenience. Scarborough CFA CCF MCF March 8 2022 507 pm. We enjoyed seeing everyone at the Silver Spurs Rodeo Parade in downtown City of St.

Property Appraisers Office immediately at 407-742-5000. Total tax collected 6 5. Full amount due on property taxes by March 31st.

Exempt rental receipts 3. Yearly median tax in Osceola County. Plus - penalty 9.

Irlo Bronson Memorial Hwy. Property Appraisers Office immediately at 407-742-5000. Receive 1 discount on payment of real estate and tangible personal property taxes.

Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The gross amount is due by March 31st of the following year. Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Tax statements are normally mailed out on or before November 1st of each year. If you need any assistance you can call us at. Receive a 3 discount on payment of real estate and tangible personal property taxes.

On average Osceola County residents pay about 348 of their yearly income on their property tax. An owner of eligible property may file a completed summer property tax deferment form with his or her city or township treasurer before September 15th or before the date your summer taxes. Electronic copies of future bills will be emailed to you when they become due.

At least one field is required for the basic search not all fields must be filled in. Taxable rental receipts mailing address 4. 6 - PRIOR YEARS TAXES DUE DELINQUENT TAXS OWED.

In cases where the property owner pays through an escrow account the mortgage company should request and be sent the tax bill and the owner receives a copy of the notice. When paying property taxes by parcel number please enter the 10 digit parcel number which appears in the bottom right corner of either payment stub. The delinquent amount is not reflected on this notice and must be paid with guaranteed funds.

Welcome to Osceola County Iowa. Click on any of the following links to make a payment. Total tax due contact 7.

Learn all about Osceola County real estate tax. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143. To pay property taxes by installment complete the form below and return this application to your county tax collector by.

Penalty Starts October 3rd September 15 2017 - 638 pm - Posted in News Statewide Iowa If you havent paid them yet you have about two weeks left to pay the fall installment of property taxes in Iowa without having to pay a penalty. Osceola Tax Collector Website. Less-collection allowance address 8.

Search all services we offer. Fields marked with a. Learn all about Osceola County real estate tax.

Osceola County Property Appraiser Katrina S. Cloud Florida a couple of weeks ago. The certificate holder is paying for the taxes for a property owner in exchange for a competitive bid rate of return on hisher investment.

If prior years taxes are unpaid a message will appear on your bill stating PRIOR YEARS TAXES DUE. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. Summer taxes are due by September 14 without interest.

Physical location of property located in osceola county. Call 407 742-4000 for amount due. In order to remove the lien the property owner must pay the Tax Collector all delinquent taxes plus accrued interests penalties and advertising fees.

If prior years taxes are unpaid a message will appear on your bill stating PRIOR YEARS TAXES DUE. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

Property Search Osceola County Property Appraiser

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Design Standards Document For Sdoc Osceola County School

Osceola County Property Appraiser Open Data

Property Tax Search Taxsys Osceola County Tax Collector

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

Contact Us School District Of Osceola County

Curriculum Amp Instruction Consent Agenda Osceola County School

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

Pin By Michele Mehnert On Homebuying Business Tax Property Tax Home Buying

Osceola County Florida Property Search And Interactive Gis Map

Osceola County Approved The Tavistock Concept Plan Which Includes A Man Made Lake And Marina In Sunbridge Orlando F Florida Homes For Sale Tavistock Osceola

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

3318 Cat Brier Trl Harmony Fl 34773 In 2021 Apartments For Rent Apartment Harmony