student loan debt relief tax credit program for tax year 2021

Applications must be submitted by September 15. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

The suspension period was originally set to apply from March 13 2020 to Sept.

. Is there relief for student loan debt during COVID-19. September 2 2021 - Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit Program for Tax Year 2021. This tax credit is given to help students offset some of.

The Student Loan Debt Relief Tax Credit is a program created under 10. You can claim the deduction if all of the following apply. The Student Loan Debt Relief Tax Credit is a program.

We are aware that student loan debt has become a growing concern among college graduates and wanted to remind you of a tax credit that you may be able to take advantage of. Under normal circumstances your tax refund can be garnished to pay student loans in default. Cancel up to 50000 in student loan debt for borrowers with 100000 or less in household gross income.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. You paid interest on a qualified student loan in tax year 2021. Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance.

One of Congresss economic responses to the COVID-19 crisis is a temporary tax incentive for. This action remains in effect until January 31 2022. Provide automatic cancellation using data already available.

The Maryland Higher Education Commission MHEC is continuing their Student Loan Debt Relief Tax Credit for 2021. The Student Loan Debt Relief Tax Credit is a program created under 10-740. The means to access Arises from a past Taxation Credit.

Click Now Apply Today. From July 1 2021 through September 15 2021. If you have experienced a tax refund offset related to your student loans since then you should reach out to the Treasury Offset Program to see if youre eligible to have some of that money returned.

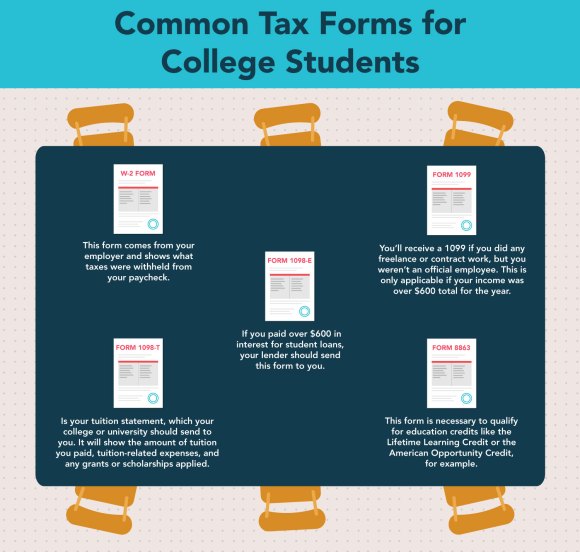

Taxes are due April 18 this year and if you havent filed yet and are one of the 43 million Americans with student loan debt there are certain tax. Table 1 continued Program Name Brief Description. Updated for filing 2021 tax returns.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve low-income families and meet other qualifications you may be eligible for forgiveness of up to a combined total of 17500 on eligible federal student loans. 16 hours agoThe Tax Cuts and Jobs Act of 2017 exempted federal taxation on Total and Permanent Disability TPD discharges a student loan cancellation program for disabled borrowers.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. It was founded in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators. Eligible students are reimbursed for up to 2500 annually for a total of two years for qualifying student loans.

About the Company 2021 Student Loan Debt Relief Tax Credit Maryland. Youre legally obligated to pay interest on a qualified student loan. But that relief is.

This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. Your filing status isnt married filing separately. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. Its regrettable that the cost of higher education is preventing many people from pursuing their college dreams Comptroller. Suspended payments will appear as regularly rescheduled payments by credit-reporting agencies.

The student must be employed by a qualifying company when he or she applies for the reimbursement. In October 2021 the Biden administration overhauled the program to give borrowers credit for past periods of repayment that previously didnt count which resulted in 5 billion worth of student. Student Loan Debt Relief Tax Credit for Tax Year 2021.

In 2021 9155 Maryland residents received the Student Loan Debt Relief Tax Credit. One form of relief came through the suspension of payments on federal loans held by the Department of Education. Pay Off Your Tax Bill with a PenFed Personal Loan.

Individuals paying back federal student loan debt can defer payments and interest through May 1 2022 approved December 22 2021. Complete the Student Loan Debt Relief Tax Credit application. Those who attended in-state institutions received 1067 in tax credits while eligible applicants who attended.

Ad Read Expert Reviews Compare Student Debt Forgiveness Companies. It was founded in 2000 and is an active part of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. Provide partial debt cancellation for each borrower with household gross income between 100001 and 250000 by reducing the cancellation amount by 1 for every 3 in income over 100000.

Student Loan Debt Relief Tax Credit for Tax Year 2021. 2021-R-0044 December 28 2021 Page 3 of 6. About the Company Tax Relief For Student Loans.

There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. CuraDebt is an organization that deals with debt relief in Hollywood Florida. Your MAGI is less than a specified amount which is set annually.

Facing Scrutiny Biden Administration Extends Student Loan Pause Until May Student Loans Student Loan Payment Student Debt Relief

Private Student Loan Forgiveness Alternatives Credible

The Full List Of Student Loan Forgiveness Programs By State

Can Debt Forgiveness Cause A Student Loan Tax Bomb Turbotax Tax Tips Videos

Taxes And Student Loan Forgiveness Updated 2021

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Is Student Debt Cancellation Next

10 000 Or 50 000 Student Loan Forgiveness Could Biden Eliminate Debt Through Executive Order In 2021 Student Loan Forgiveness Student Loan Debt Forgiveness Debt Plan

How The President Is Helping With Student Debt Loans Student Debt Student Loan Forgiveness Student Loan Consolidation

Here S How To Get Student Loan Forgiveness Student Loan Forgiveness Graduate Student Loans Refinance Student Loans

Start Streamlining Your Procedure And Assembly Line Of Sorts Put Your Packages Together Keep T Public Service Loan Forgiveness Loan Forgiveness Student Loans

Can I Get A Student Loan Tax Deduction The Turbotax Blog

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way

Here S What Happens If You Default On Your Student Loans Student Loans Refinance Student Loans Federal Student Loans

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

Gross Vs Net Income Net Income Debt Relief Programs Credit Card Debt Relief

New Stimulus Package Makes Student Loan Forgiveness Tax Free Student Loan Hero